Kotter's 8-Step Change Model Kotter's 8-Step Change Model by: Scott E McGlon In today's fast-paced and competitive business landscape, successful execution hinges on effective strategic planning and implementation. To navigate this complex environment, organizations rely on a myriad of business tools and frameworks. This comprehensive guide explores the utilization of essential tools such as OKRs, KPIs, Balanced Scorecard, Ansoff Matrix, BCG Matrix, and the Blue Ocean Strategy to generate, evaluate, and execute strategic options. Additionally, we dive into communication plans, implementation management, and post-implementation evaluation strategies. All three sections are critical to define, and ultimately achieve, optimal results. Whether you are a startup or an established company, these tools and techniques are invaluable for achieving your strategic objectives. In each section below, we have provided, what we think, is the most appropriate and thorough link for each business tool and frameworks. This will give you the ability to dive into each business tool outlined to get a clear perspective on how they can impact your business in the most optimal way. Section 1: Setting the Strategic Foundation 1.1 Objectives and Key Results (OKRs) OKRs provide a goal-setting framework that aligns everyone in the organization with the company's strategic objectives. They consist of clear, measurable objectives and key results that measure progress toward those objectives. OKRs help organizations define their priorities, track performance, and foster accountability. 1.2 Key Performance Indicators (KPIs) KPIs are quantifiable metrics that measure the success of various aspects of a business. They serve as crucial benchmarks for tracking progress, identifying areas for improvement, and ensuring that strategic goals are met. Choosing the right KPIs is essential for effective performance management. 1.3 Balanced Scorecard The Balanced Scorecard is a comprehensive framework that translates an organization's mission and strategy into a set of performance measurements. It helps businesses balance financial and non-financial indicators, providing a holistic view of performance across four perspectives: financial, customer, internal processes, and learning and growth. Section 2: Generating Strategic Options 2.1 Ansoff Matrix The Ansoff Matrix is a tool that assists in exploring growth strategies. It presents four growth options: market penetration, market development, product development, and diversification. By analyzing these options, businesses can identify the most suitable growth strategy for their current situation. 2.2 Boston Consulting Group Matrix (BCG Matrix) The BCG Matrix categorizes a company's products or business units into four quadrants: stars, question marks, cash cows, and dogs. This matrix helps organizations allocate resources effectively by focusing on products or units with the highest growth potential and market share. 2.3 Blue Ocean Strategy The Blue Ocean Strategy challenges traditional competition-based strategies by encouraging businesses to create uncontested market spaces (blue oceans) rather than competing in saturated markets (red oceans). It involves innovation and value creation to make competition irrelevant. Section 3: Implementation and Communication 3.1 Establishing a Strong Communication Plan Effective communication is essential during strategy implementation. Tools like Gantt Charts, RACI Matrices, and Kanban Boards help teams communicate tasks, responsibilities, timelines, and progress effectively.

Section 4: Evaluating Results and Outcomes 4.1 Strategic Planning Framework for Evaluation Evaluating the results and outcomes of strategy implementation is critical for continuous improvement. Use tools like dashboards, scorecards, and After-Action Reviews (AARs) to assess performance and gather insights.

Section 5: Additional Strategies for Startups and Established Companies For startups:

In conclusion, effective strategic planning, implementation, and evaluation are paramount for long-term success with any business. Leveraging a comprehensive toolkit of business tools such as OKRs, KPIs, Balanced Scorecard, Ansoff Matrix, BCG Matrix, and the Blue Ocean Strategy provides organizations with the means to navigate uncertainty, make informed decisions, and achieve strategic goals. By complementing these tools with robust communication plans and post-implementation evaluation strategies, businesses can adapt to changing landscapes, drive new innovations, and continuously improve their performance, regardless of their stage of development. What Peter Drucker said decades ago certainly applies for every business operating today: What gets measured, gets managed! About the Author: Scott E McGlon is the President of McGlon Properties, LLC and the author of many blog post on MP Blog. He has been a serial entrepreneur, investor, and president of many successful start-ups since 1998.

0 Comments

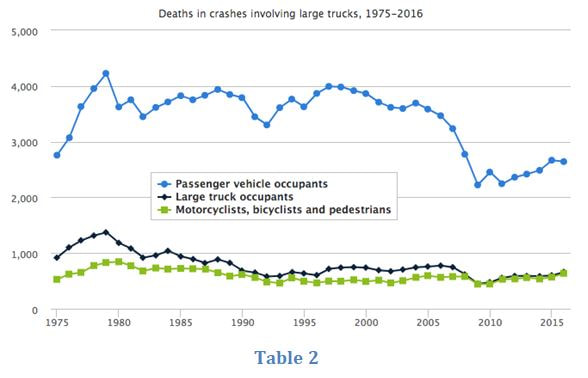

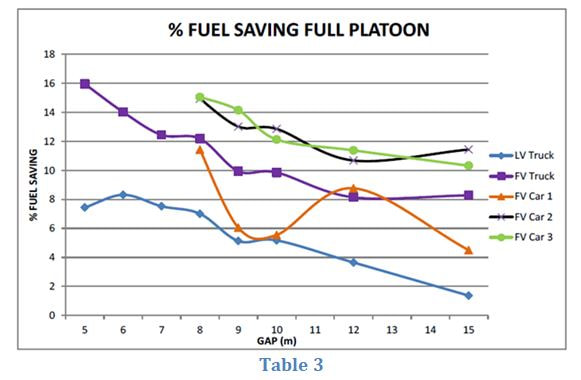

Startup pitch competitions are getting more popular each year. Almost any college or university with an entrepreneurship program hosts at least one pitch competition annually. More importantly, the prize money keeps growing with some competitions yielding $100,000 split amongst the first, second, and third place winners. To help prepare young entrepreneurs for their pitch competitions, I opened my scribbled notes, questions, and comments from many years of witnessing, judging, and administering pitch competitions. The result is that I have extracted what I think to be the best questions for which you should prepare. But before you rely too heavily on this list, be aware each panel of judges consists of different personalities and backgrounds for which you cannot totally prepare. These professionals, who you've never seen before, boldly sit there ready to build you up or tear you down. True story - in 2018, a team I coached spent hours brainstorming every question we could think of and strategically preparing the best answers. We felt assured we covered the gamut of possibilities. It turns out, the judges focused on something very minuscule from their presentation regarding some research they referenced. For us, it was not a pertinent part of the overall picture, but a particular judge utilized much time in exploring this minor topic. In other words, you just never know where the line of questioning will go. Regardless, knowing the most popular questions and being prepared to answer them is a no-brainer! So, here you go: 1. What are your top two or three priorities after this competition? 2. What is your startup going to be known for after year one? 3. How does your product/service work and how big is the market? 4. Who is your customer and do you know what your customer acquisition cost will be? 5. What proof is there that this is a real problem? 6. What is it about your team that makes them perfect to bring your product/service to market? 7. If you win this competition, what will you use the money for? 8. Why is your product/service better than what’s already on the market? 9. Who are your competitors and what will be the biggest challenge in unseating the top competitors in your market? 10. Do you plan to protect your product/service? If so, has a provisional been filed? 11. What proof is there that this is the right solution? 12. Why can't another company do what you are doing? Why can you do it better, faster, and/or more effectively? 13. What’s your barrier to capacity? 14. How much traction do you need to obtain to clearly define your solution is working? 15. Why is right now the right time to solve the problem this way? 16. Everyone says they can monetize the data they collect. What’s your plan? 17. Can you explain your revenue model and how you came up with it? 18. What’s your average margin? 19. Are you charging too little? 20. Are you charging too much? 21. How often does your product/service show up in your average user’s day or week? Are those numbers sustainable or projected to grow? 22. What is the most probable way you will scale this business? 23. What regulatory approvals are needed to get your product or service to market and how have you progressed so far? 24. What is the top business metric(s) you will be monitoring right out of the gate with your business and why? 25. I know it is very early, but what do you see as the most logical exit down the road? Share with us your favorite question from a pitch competition in the comments below. Best of luck to all of the young entrepreneurs getting ready for the next pitch competition. Give your presentation to as many audiences as you can, because each can provide a valuable perspective. Practice, practice, practice...and then practice some more. The more you make your two, five, or eight minute pitch, the better. Many of us accept what we own without questioning where it came from or how it got to us. Trucking is the mode of transportation that carries 70% of all freight transported in the United States, accounting for $671 billion of goods carried annually. The industry itself generates $225 billion in total revenue each year, making up 10.2% of GDP in the United States. Without trucking, American businesses, governments, and homes would come to a halt. The reliance on the trucking industry has only grown with decreasing product cycles and increasing consumer demands. While the industry is constantly adapting to be more efficient, it still is fueled by outdated technology reliant on fossil fuels. In turn, the increase in transportation has stimulated an increase in greenhouse gas emissions in the trucking industry. This paper will cover some current issues surrounding trucking and why they will stimulate change, what companies are doing to make trucking more sustainable, and the change consumers can spark in the industry. Trucking Industry IssuesOne of the major issues in the trucking industry is reliance on fossil fuels, which are harmful to the environment and to a company’s bottom line. On average, 88-92% of a trucking company’s revenue goes towards operating costs, the highest being labor closely followed by fuel. According to the American Transportation Research Institute, fuel accounts for 30-40% of a motor carrier’s Cost Per Mile (CPM) and is projected to increase with higher fuel prices this year. This coming summer (2018), gasoline prices are expected to be higher than they have been in four years (Table 1). This price change can be linked to global demand increases in growing countries, with China alone increasing its oil consumption by more than 350% since the 1980s. In addition to this, President Trump and the US Chamber of Commerce are working towards phasing a $0.25 tax increase on fuel over the next five years. While this will go towards improving transportation infrastructure, trucking operations will experience higher operating costs as a result. An increase in the price of deliveries is not a feasible option to outweigh fuel costs, because of the highly competitive nature of the transportation market. Instead, companies must turn towards decreasing consumption of fuel and increasing load and route capacity. This turns the solution towards procuring sustainable trucks and software that support low fuel consumption, and, in turn, decrease greenhouse gas emissions. SAFETY Outside of the monetary issues within the trade itself, the trucking industry has faced continued scrutiny over safety related issues involving passenger vehicles, commercial trucks, motorcycles, bicycles and pedestrians. In 2016, there were 3,986 fatalities from accidents involving commercial Class 8 trucks with 66% involving passenger vehicles and 17% involving other commercial trucks. While the industry has seen an overall decline in deaths since 1975 (Table 2) it still accounts for 11% of fatalities on roads, leaving room for vast improvement. Trucking Company ActionsWith companies realizing the positive impact sustainability has on both their bottom line and safety, many are taking action to further integrate it into their business model. Three methods they are using are route planning, fuel-efficient technology, and pre-ordering emissions-free vehicles. Route Planning Route planning technology is not like Google or Apple Maps, because it tailors the directions to large trucks, taking into account fuel costs, turns and terrain. These systems are improving every year, with the majority of motor carriers using them in their operating structure. With over 40 systems competing in the current market, companies can cater the software to their specific needs and services. Because of this, route planning has become the norm in the trucking transportation and delivery markets, realizing billions of gallons in fuel savings over the past ten years. This technology will only continue to adapt and improve with changes in infrastructure, Artificial Intelligence (AI) capabilities and fuel-efficient trucks. Fuel Efficiency The need for increased fuel efficiency in trucks can be seen in the 53.3 billion gallons of fuel was consumed for business purposes alone in 2015. Fuel economy standards call for semis to have 7.2MPG on flat roads, but, realistically, the average truck only receives 5.6MPG when taking into account speed fluctuations, terrain variability, road obstructions and other obstacles that decrease fuel economy. Many companies are already combatting this with ways to increase fuel efficiency through hybrid trucks and platooning. Fuel Efficient Vehicles:

Fossil Fuel and Emissions Elimination The next step in fuel economy improvements is eliminating the need for fossil fuel completely. Hydrogen fuel cell and battery powered trucks will soon takeover the short-haul industry and be integrated into longer hauls in the near future. Hydrogen fuel cell trucks create their own energy by pulling electrons from compressed hydrogen in a compact fuel cell stack. They are refueled by hydrogen refueling stations, which are not prevalent in the US right now. Because of this, there is a bottleneck in their inability to travel long distances. An example of this is Toyota’s hydrogen fuel cell truck, which began drayage testing in the Port of Las Angeles to make short hauls to local DCs and warehouses. Its success is evidence that this technology could transform last-mile deliveries to commercial and residential areas but lacks flexibility in the services it can provide. However, this innovation does have room to grow, with Nikola recently unveiling their Nikola One hybrid hydrogen fuel cell truck with a range of 500 – 1,200 miles. Companies won’t be able to benefit from its efficiency until it begins production in 2021 and develops proper hydrogen refueling stations. Until then, local deliveries by hydrogen powered trucks will become more efficient and prevalent with continuous R&D. In November 2017, CEO and Chairman of Tesla, Elon Musk, announced that the fully electric powered Tesla Semi would hit production lines in 2019. In its unveiling, Musk discussed its 500 mile range, platooning and self-driving capabilities, aerodynamic design, and low operating cost. Traveling alone, the Tesla Semi decreases operating costs by 14.37%. This savings in operating costs is considerably increased to 43.71% when the Semi engages in a platoon convoy. Motor carrier leaders like JB Hunt and Wal-Mart have already placed orders for Tesla Semi fleets, and the public can expect to see them piloted over the next year. While the integration of these vehicles creates questions about where the hydrogen and electricity are coming from and the sustainability of the production process, industry leaders paired with market entrants are setting the pace to revolutionize our energy source for delivering goods. COnsumer ImpactWhile it is easy to put the task of lowering commercial transportation impacts solely on companies, consumers must also evaluate what they are doing to drive the problem. At the heart of global demand increases that have stimulated increased transportation and emissions is consumer demand. 20th Century innovation and invention have enabled the population to have limitless access to real-time information, instituting the ease of making online purchases. E-commerce companies utilize free express shipping as a leverage point to capture consumer interest; however, when a consumer uses this express shipping option, it drastically lowers a company’s ability to fill a truckload. Lower truck capacity means more loads that go out, increased fuel consumption, higher company variable costs, and unnecessary packaging and emissions. On top of that, many companies are actually losing profit margin when providing that option for free. Waiting two or three extra days for a package to arrive allows the company to fill more loads and travel fewer miles. Choosing standard shipping, purchasing sustainably sourced products and educating others on where their products are coming from and how they got there are just a few things consumers can do to take action. The result of these actions will give consumers a different perspective on consumption and promote the companies and industries that are doing their best to be sustainable in production and transportation practices. Over the coming years, the trucking industry will experience exponential change, sparking an overall decrease in fuel consumption and emissions that have been negatively impacting the environment for too long. With variable operating costs absorbing 90% of revenues, companies are realizing the correlation between sustainability and safety, monetary and market benefits. Today, trucking market leaders are setting the pace for a more sustainable future, where the gap between modest change and emergent failures will steadily be closed. This will be accomplished through the technologies that enable fuel efficiency, increased safety and decreased labor demands that lower the cost to the economy, society, environment, and future generations. Written 5/2/18, Updated 6/26/18 Works Cited: Ashanti, Kiara. “The Truth About Why Gas Prices are Rising so High.” Money Crashers, 2012, https://www.moneycrashers.com/why-gas-prices-rising/ Cakebread, Caroline. “Tesla’s New Electric Semi Truck Could Work Wonders for Cutting Down Greenhouse Gas Emissions.” Business Insider, 17 Nov 2017, http://www.businessinsider.com/teslas-electric-semi-track-and-greenhouse-gas-emissions-chart-2017-11?r=UK&IR=T “Fatality Facts.” Insurance Institute for Highway Safety, 2016, http://www.iihs.org/iihs/topics/t/large-trucks/fatalityfacts/large-trucks Hill, Sean. “Summer Gasoline Prices Expected to be Highest in Four Years.” US Energy Information Administration, 2018, https://www.eia.gov/todayinenergy/detail.php?id=35752 Gardner, Lauren. “Trump Endorses 25-Cent Gas Tax Hike, Lawmakers Say.” Politico, 14 Feb 2018, https://www.politico.com/story/2018/02/14/trump-gas-tax-409647 Murdock, Andy. “The Environmental Cost of Free 2-Day Delivery.” Vox, 17 Nov 2017, https://www.vox.com/2017/11/17/16670080/environmental-cost-free-two-day-shipping “Nikola One Unveiling Lead Up.” YouTube, 30 Nov 2016, https://www.youtube.com/watch?v=3no3tF2kqEE “Report, Trends and Statistics.” American Trucking Association, 2017, http://www.trucking.org/News_and_Information_Reports_Industry_Data.aspx “Route Planning Software.” Software Advice, 2018, https://www.softwareadvice.com/fleet-management/route-planning-comparison/?more=true#more Skydel, Seth. “Route Planning for Fuel Efficiency.” Fleet Equipment Magazine, 28 May 2014, http://www.fleetequipmentmag.com/route-planning-fuel-efficiency/ “Transport & Logistics Industry Operating Margin Statistics.” CSI Market, https://csimarket.com/Industry/industry_Profitability_Ratios.php?ind=1101 “Volvo’s SuperTruck Concept Vehicle.” Volvo Trucks, 2018, https://www.volvotrucks.us/about-volvo/supertruck/ Lauren McGlon is a senior at Auburn University's Raymond J. Harbert College of Business studying Supply Chain Management with a minor in Sustainability Studies. Lauren has held multiple leadership positions within the College of Business, Alpha Kappa Psi, and Auburn's Supply Chain Management Association.

UPDATED: 4/17/19

Every entrepreneur possesses specific goals & objectives for their new business. Most goals & objectives take multiple steps to reach or exceed the original expectation(s) of the entrepreneur. Milestones represent the steps to achieve goals & objectives. While many milestones may be unique to your specific startup, there are certainly a few you need to take note of since they apply to 98% of every startup. Below is a list of the many milestones that my past startups went through. They were recorded on many calendars dating back to 1998 when I first started in my third car garage in Houston, TX. Most entrepreneurs will reflect on your calendar of milestones and realize it represented your road-map to success. To make it easy to stay organized, I have broken down the milestones into categories that match your progression as a startup. It is important to note that the "Kick-off" category of milestones are all required. Get them out of the way so you can focus on the meat and potatoes of really starting your business by knocking on your first door and getting the first dollar in the bank! I threw in a few pre-qualifiers that will help determine if your business idea has legs. Determine if Your Idea is a Business

Pre-Business

Pre Kick-off

Revenue

Traction – objective is to start getting your new company out within your targeted marketplaces and established. Traction is not centric to just marketing but should also be focused on getting your business working toward its initial foundation.

Business Development

Team

Resources

Remember the objectives of working your milestones - keeps your priorities straight and in order, drives accomplishments and accountability, and keeps your most precious asset (time) on what's important. Your feedback is always welcome! Scott E McGlon is the President of McGlon Properties, LLC and the author of many blog post on MP Blog. He has been a serial entrepreneur, entrepreneur-in-residence, investor, and president/CEO of many successful start-ups since 1998.  Even in the early stages of building a business, many entrepreneurs are attracted to exploring patents. For most entrepreneurs, protecting your business idea from getting stolen is usually a priority. As a young entrepreneur, I made a lot of mistakes. One of those mistakes was not protecting the intellectual property (IP) with patents in my businesses, specifically the processes, software, and designs I created. Of the four different IP's identified by the USPTO (trade secrets, copyright, trademarks, and patents), patents are the most expensive, time consuming, and carry an unknown result going in. For the most part, not pursuing patents did not hurt me. I stayed focused on operations and executing my business plans day in and day out. If I spent thousands to protect my ideas, I would spend thousands defending them once patented. Always remember that an idea is just organized thoughts. Writing out the idea, putting a team together, and executing that idea takes special entrepreneurial characteristics most do not possess - even if they want to knock off your idea. So, as an entrepreneur, you have to make the decision on whether or not protecting your idea(s) with a patent is the best route to take. No matter what you hear, I know for a fact that getting your idea out there, establishing market momentum/sales, and putting strong processes in place to duplicate success trumps spending months applying for and waiting to get "protection" in a lot of new business startups. I've actually seen, multiple times, young entrepreneurs spend the majority of their critical early startup time talking with attorneys, paying those attorneys, and filling out paperwork. Yes, there are plenty of true proprietary ideas that not only "need" protecting but MUST be protected with technology leading the way. Just know if Apple, GoPro, and many other billion dollar publicly held companies can't stop patent infringement, you will struggle as well. First and foremost, keep your mouth shut in the early months. I'm serious. Posting on social media, sending out emails, and even telling your friends gives you little to no positives. Identify, design, and start executing your plan to get a head start. If you are super excited and passionate about your new business idea, act on it but don't blab it to the world until it is GO TIME! There is a time and place for marketing, but the early stages is not the appropriate time. This article is focused on other ways to protect your company without filing a utility patent, design patent, or both. I am going to put the following in bullet points so they are easy to find again. The list is critical to ALL entrepreneurs no matter how much thought (or lack thereof) you have put towards protecting your business. At the very least, do the simple things first:

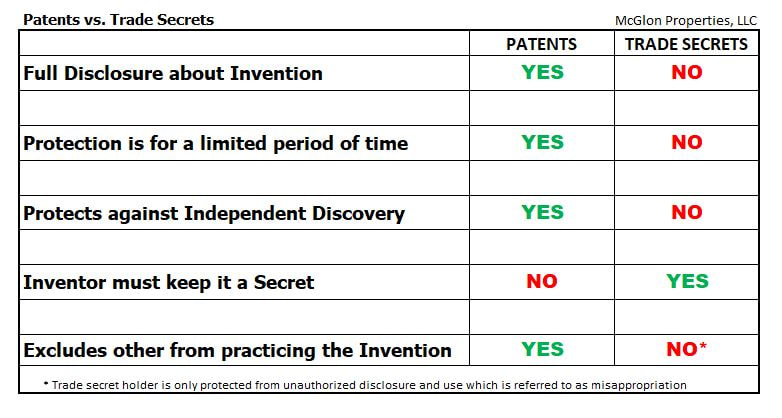

So, once you get the "easy" out of the way and you still do not know what you should do, every new entrepreneur can do some or all of the following beyond just hitting the four IP categories. What a lot of young entrepreneurs do not know, TIME is actually on their side. PURSUE FILING A PROVISIONAL PATENT Your very next step is to get a provisional patent application completed and in to the USPTO office. This allows you to put "patent pending" on your docs, website, app, etc. This gives you 365 days to jump start your business. You do NOT need an attorney to file for a provisional patent. There are a lot of reputable online companies that charge $100 or less to get your provisional filed with the USPTO. Don't be lazy! WORK OFF OF AND INCORPORATE NON-DISCLOSURE AGREEMENTS Get used to working with NDA's. Just keep it in the back of your mind with everyone you work with - potential investors, mentors, suppliers, associates, partners, workers, and even commercial clients in some cases. You will run into plenty who will not want to sign NDA's with investors at the top of the list. To get around this, consider putting confidentiality statements within your business plan, supplier contracts, employment new-hire paperwork, etc. Non-compete agreements can also serve a significant purpose in protecting your business if you can get them signed. TRADEMARK YOUR BUSINESS NAME, TAG LINE, AND LOGO Since business names are often tied to the actual business idea, Trademarks can be very useful and can serve as an additional layer of protection. Unfortunately, a lot of new entrepreneurs forget to check if their new company name or artwork has been trademarked already. The documentation that is required to file a trademark will serve as written official proof that your idea was set-in-stone on the specified date you filed. For no other reason, this justifies getting your biz name, tag line, and logo trademarked. At the very least, get your name completed. USE AND NOTE TRADE-SECRETS Trade secrets should be used only as a compliment to a patent. As an entrepreneur, you can't use a trade secret in lieu of filing a patent. Trade secrets consist of information and can include a process, formula, pattern, compilation, program, device, method, or special technique. To meet the most common definition of a trade secret, it must be used in business, and give an opportunity to obtain an economic advantage over competitors who do not know or use it. Although in 2016, the Defend Trade Secrets Act was created which strengthens U.S. trade secret protection under federal civil cause of action. But trade secret protection is still very limited. Note that a trade secret holder is only protected from unauthorized disclosure and use which is referred to as misappropriation. If a trade secret holder fails to maintain secrecy or if the information is independently discovered, becomes released or otherwise becomes generally known, protection as a trade secret is lost. Trade secrets do not expire so protection continues until discovery or loss. DOCUMENT GALORE Start your business with the discipline to put everything in writing. Keep it simple but use your head by noting who you have talked to about your business idea and what was discussed. By keeping a diary, calendar, or log of every discussion you have where details of your business are disclosed, you not only stay organized but you have a written history of who, what, and where your business and ideas were discussed. Your dated log will help if you find one of those conversations goes somewhere it shouldn't. PATENTS VS. TRADE SECRETS I get a lot of questions concerning patents vs. trade secrets so I want to outline the difference. Patents require the originating inventor to provide a detailed and full disclosure about the invention in exchange for the right to exclude others from practicing the invention for a limited period of time. Patents do expire, and when that happens,the patent becomes null & void and is no longer protected. Unlike trade secrets, patents may protect against independent discovery - the most important point of a patent. Patents also give the business owner FREEDOM by eliminating the need to maintain secrecy. While most anything can be kept secret, there are limitations on what can be protected by a patent. If a given invention is eligible for either patent or trade secret protection, then the decision on how to protect that invention depends on business considerations and weighing the relative benefits of each type of intellectual property. See the chart below showing the differences between the two. In conclusion, the odds that your idea will be stolen is slim-to-none. I am living proof, along with quite a few of my entrepreneur colleagues. I am truly sadden by what some of the patent attorneys do to young entrepreneurs. I invest a lot of my volunteer time making sure they understand the truth. Don't inhibit your ability to sell your idea by being scared someone is going to knock it off - especially if you are passionate, driven, and possess a "no matter what" attitude that your idea will be a successful business. An investor or client who declines to work with you may actually know someone else in the industry looking to work with someone offering exactly what you’re offering. If you prevent that interaction from occurring, you could be missing a great opportunity. Another way your fears hurt your business is that they keep you from getting feedback from others. When you discuss your idea with someone new, you get their thoughts, which in turn helpsyou grow your concept. By never discussing your business with others, you miss that chance. If you’re truly concerned about your idea being stolen, taking a couple of the above-mentioned steps can give you a little peace-of-mind. But chances are, your idea is safe. Few people have an interest in stealing other people’s business concepts and putting them into action. In fact, there are far more people with ideas that won't be seen to fruition. Be proud of your invention, but share it only with those who can help you in your dream of making your vision a reality.  Before we get to the 50 questions, the first question you need to ask is do you even need a partner. With roughly 22% of startups starting as partnerships, it certainly is a popular choice but is not close to the 78% that start as a sole proprietorship. There are a lot of pro & cons to a partnership but before signing on the dotted line, make sure you ask the following questions with your planned partner sitting right next to you! Company Name, Location and Hours 1. What are the partners’ names? Are they individuals, corporations or Limited Liability Companies? What is the designated name and purpose of the partnership? 2. Is each partner cool with the company name and tagline? Will we register the company name and tagline as a trademark? 3. Where will the office be located? Will we own it or rent it? Will any partners work out of a home office full-time or part-time? 4. What will be our working hours? What autonomy will partners have to set their own hours? Do we need to service clients during any certain time each day? How often will the partners meet to discuss business? Can the partners agree on a minimum number of hours each will work each week no matter what? Contribution to Capital - an entry on the shareholders' equity section of a company's balance sheet that summarizes the total value of stock that shareholders have directly purchased from the issuing company. 5. What will each partner contribute to the business in terms of:

Accountability 7. How will each partner measure the job performance of the other partner(s) and hold each accountable for meeting expectations? It is critical that expectation/roles of each partner are clearly drawn out with key performance indicators established. Taxes 8. What partnership structure will be chosen and how will that affect our taxation? e.g. general partnership, limited partnership, limited liability partnership (LLP) limited liability company (LLC). Look at each closely and make the best decision that all partners agree with. Liability 9. Will the Agreement limit the joint and several liabilities that partners have by law for their partners’ behavior? Will the partners’ contractual commitments and representations bind each partner? 10. What is the liability and repercussions if one of the partners does something illegal while representing the company? 11. What is each partners specific percentage responsibility to company debt? 12. How will authority and decision making be structured? Will the partners operate by general consensus? Or, will it be based on share of ownership? What is the tie-breaking mechanism used to avoid deadlock? Will partners have authority to control certain functional areas of the business without the approval or involvement of the other partners? What is the authority to act on behalf of the company without unanimous agreement? 13. What is the procedure for borrowing money in the company name? When does borrowing require approval of the other partners? What is the scope of expense account authority before needing to consult with the other partners? Responsibilities 14. Who will handle what? How will your roles and responsibilities be divided? Who will have what management duties? 15. How will workload be assigned and monitored? Each partner must be open to the other partner(s) holding them accountable. Always remember the end goals & objectives of the company and take all pride out of the equation. Personnel 16. How will the partners choose a lawyer, accountant, banker, insurance agent or any other professional service provider? 17. What process will be used to expand and admit new partners? 18. How will the partners hire employees or contract workers? 19. How will the partners select third-party vendors and suppliers? 20. How will the partners select customers or clients? Insurance 21. What kind of business liability and/or property damage insurance will the company purchase? Who decides on the coverage and limits? 22. Will we provide medical, life or disability insurance or a pension plan for the partners and employees? 23. Will the partners provide key man insurance on the lives or disability of the partners? Will the company pay for all legal fees if one of the partners gets sued in the company name? Ownership and Compensation 24. How will ownership percentages be determined? 25. If one partner had the original idea for the business, should he/she receive compensation or additional ownership rights? 26. How will profits be apportioned? How will losses be allocated? 27. What amount of profits will be withheld for investment back into the business? 28. How will salaries or draws against profits be determined? 29. How will company perks be assigned? Cars, event tickets, dinners, etc. 30. What other benefits will we provide? Vacation, holidays, bonuses, sick time, etc. 31. How will we provide for the unexpected? Serious family illness, disability, or some other life event that disrupts a partner’s ability to work productively? 32. What extent of absence from productive work will require renegotiation of the partnership agreement? 33. Who will keep the books? What financial statements will the partners receive? How regularly will they be prepared? 34. Are there any restrictions on engaging in other outside business activity? 35. Will partners forbid conflicts of interest and direct competition – require each to sign an NDA and non-compete for example? Note that this is illegal in some states. Buy/Sell Agreement 36. What happens to the business assets if a partner dies? 37. How will the value of the partners’ shares of the business be determined? 38. If a partner leaves, will the company pay for his share? Can a departed partner remain as an investor? 39. Will a departing partner receive the same amount for his share if he joins the competition? 40. What restrictions and approvals apply to a partner selling his share of the business to a third party? 41. Do the other partners have a right of first refusal for the shares of a partner who dies or leaves? 42. Can partners be involved, including owning, another business? 43. What is the process for firing a partner for incompetence or malicious behavior? What happens if a partner becomes impaired by drugs or alcohol, or gets arrested? 44. What process will we follow if an outsider offers to buy the business? What valuation method will the partners agree on? 45. Upon dissolution of the partnership, how will shared assets be divided? 46. Who gets the rights to intellectual property, customer lists, company files and records? 47. Who can continue to use the company name and logo? 48. What method of alternative dispute resolution (arbitration or mediation) will be used in lieu of litigation to resolve disputes between the partners? How will the arbitrator/mediator be chosen? 49. What is the procedure for amending the partnership agreement? 50. If a partner fails to make a contribution as provided in the partnership agreement, or otherwise violates the agreement, what are the consequences? Yes, these questions can be a little over-whelming. While some are more important than others, they are all important to avoid the inefficiencies they can cause if each are not accompanied with an answer that all the partners agree on. As they say, life and business will go by much smoother if your ducks are in a row. Scott E McGlon is the President of McGlon Properties, LLC and the author of many blog post on MP Blog. He has been a serial entrepreneur, entrepreneur-in-residence, investor, and president/CEO of many successful start-ups since 1998. There are a lot of entrepreneurs who like to start a business with a partner with thoughts that it will be easier, less risky, and that you will have someone to lean on. What is a clear fact based on statistics, a partnership that is formed without a thorough due diligence and clarity of responsibilities & roles is likely to fail. Trust me...I know first hand! So what makes successful partnerships work? I am going to share my experiences and opinions.

According to the United States Small Business Administration (SBA), businesses with multiple owners are more likely to survive longer than those who go out on their own. The basic new start-up stat everyone uses regarding 66% of new businesses fail within the first year or two is a motivating factor to cover up this statistic the best you can. Some think going into a partnership arrangement helps reduce the probability of being a part of this stat...and I agree under the right circumstances. It is a fact that partnerships are the simplest and least expensive of co-owned business arrangements. Forming a partnership can either be a good or bad thing, depending on the parties and circumstances involved. To Consider

Some pros

Some cons

Before entering into a partnership, it would be best to first determine whether or not you are suitable for this type of arrangement and, if so, to thoroughly investigate possible business partners. Is your prospective business partner a good match? A business match is much like a marriage. Just as one would normally take great care in the selection of a mate, you must be careful with a prospective business partner. Here are some questions to ask yourself to find out if you’re compatible:

Avoid any potential problems by making sure duties and responsibilities of each partner are detailed in a legal agreement. This agreement should include how much capital each will contribute; who owns what; how decisions will be made, profits will be shared, disputes will be resolved; a buy-sell agreement; and who will be entitled to what if the partnership doesn’t work out. Be sure to involve a lawyer and an accountant from the outset to help form your partnership and to draw up legal agreement to avoid unexpected circumstances. No doubt, deciding whether or not to work under a partnership arrangement is a major decisions for you, your family, and your career. A lot rides on how the partners handle everything that is involved with the business and what decisions are made. After selling my logistics company in 2012 and my e-commerce company in early 2014, I've had some time to reflect in how differently each sold. My notes from both sales created the list of seven things every entrepreneur must cover well before selling your business.

First, I want to give you a short summary of the two sales I went through over the last few years. I elected to sell my logistics company myself and avoided private equity (PE) firms, investment bankers, and business brokers. Simply by posting my business online and getting the word out within my 20 year old transportation Rolodex, the best outcome was right down the hall as I ended up selling it to my terminal manager. The negotiations were clean and concise and lasted less than a week, only one business attorney was involved, papers were signed and the deal was done. From start to finish, the sale was complete in less than 90 days. The second time around, I hired an investment banker, put months into a CIM (confidential information memorandum) document, worked on a list a mile long of potential buyers - from PE firms to fortune 500 companies, and did multiple dog & pony shows in front of interested buyers. In the end, we got a handful of non-binding bids that all ended in disappointment for various reasons. One year later, I sold out my shares to my minority business partner. Each of these experiences produced a plethora of new found knowledge in an area I thought I knew pretty well through a few of my past experiences, books I've read, and colleagues I knew in the M&A arena. Let's just say I had no idea! I am grateful for both experiences, what I learned, and my desire to share them with other entrepreneurs. With the startling number of start-ups sprouting up everyday, it is critical to have the end in mind. The "end" is an exit strategy under your terms and within the parameters you set that triggers the start of an exit. It is healthy to think through possible exits once your business is financially stable and has a strong operational foundation. The following are seven things you must get in order and optimally presented before putting your business up for sale. Knowing this simple outline will help you set up your company for securing the best multiple of EBITDA to all potential buyers that show interest in your business. #1: Your Financial Statements must be in order from day one. As an entrepreneur, you do not want any holes in your historical financials. Get with your CPA or Controller and put together the following critical financial statements:

#2: Estimate the Value of Your Business Assets. It’s essential to list and price all physical assets of your business, including furnishings, fixtures, equipment and inventory. In my simple transaction, this was done down to every piece of furniture, computers, and office supplies. With the overwhelming approach in my e-commerce business, this was overlooked by both sides and became a mess a few months after we closed. Tangible Assets – The worth of these items is important for buyers who require you to provide a complete asset list, including purchase prices and fair market values. The worth of these assets is also very important in determining whether or not you should liquidate these assets before the sale. #3: Prepare Your Statement of Seller’s Discretionary Earnings. Work with your accountant or bookkeeper to "recast" or "stabilize" your business income statement into what’s interchangeably called a statement of owner’s cash flow or a statement of seller’s discretionary earnings (SDE). Public companies and middle market businesses are valued as a multiple of EBITDA - Earnings Before Interest, Taxes, Depreciation and Amortization. However, smaller businesses are valued as a multiple of Seller's Discretionary Earnings (SDE), which can be defined as EBITDA + Owner's Compensation AND owner perks (bonuses, company car, and other special perks the owner did for her or himself. Therefore, SDE is typically the net income (or net loss) on the company tax return + interest expense + depreciation expense + amortization expense + the current owner's salary + owner perks. #4: Estimate the Earnings Multiple That’s Likely to Apply When Pricing Your Business. Most owners receive somewhere between one and four times the annual SDE of their business, with the multiple pegged to the attractiveness of the business being purchased. Go into this with defined expectations of what you are wanting to see regarding the SDE multiple. #5: Do the Math to Arrive at an Early Estimate of Your Purchase Price. Based on how attractive your business appears in key areas that most affect its future success under new ownership, you can multiply your annual SDE by your estimated earnings multiplier to arrive at a preliminary estimation of your business purchase price. #6: Price Check! After arriving at your estimated purchase price, conduct the following research: 1) Search every online businesses for sale marketplace to research similar listings and sales in your business category, market area, and price range.; 2) Gain insights into selling prices of comparable businesses.; 3) Work with your sales agent (investment banker, broker/consultant, or adviser) to see how your pricing lines up with the prices of comparable businesses that have sold over the last 24 months. Look for trends - both up and down. #7: Research. Research. Research. You simply cannot do enough research before and during the process of getting your business ready to sell. Whoever you partner with the assist in the sale or you decide to put it on the market yourself, it is critical that you do your homework so none of the many wool blankets that are out there get pulled over your head! Good investment bankers will shoot straight but are very good at dampering your expectations, throwing out multiples that are sometimes in left field, and discounting parts of your business or intellectual property that might increase your multiple significantly. Research other business like yours and determine: who the buyers were and where they came from (industry, PE's, etc.), what multiple range over the last 24 months, and who else is for sale that might create a blind-side competition. Looking back, my simple and somewhat naive approach with selling my logistics company ended up being the best approach in a lot of ways. From being much less stressful to hitting my target sale price. However, the second time around I learned a lot in a much bigger arena. Have fun through the process and stay engaged. It just might be a life changing event that opens many new doors to choose from! Good luck. Scott E McGlon is the President of McGlon Properties, LLC and the author of many blog post on MP Blog. He has been a serial entrepreneur, investor, and president of many successful start-ups since 1998. by. Scott McGlon

As an entrepreneur, everyday I treat each day as a new challenge. Knowing my options are endless (play golf, watch sports, go fishing), if I elect to get up and work, I bring my "A" game every time. So, what are some of the attributes an entrepreneur possesses vs. people who elect to work for someone else have? The following are the "special" characteristics that run through the blood of every proven entrepreneur.

Scott E McGlon is the President of McGlon Properties, LLC and the author of many blog post on MP Blog. He has been a serial entrepreneur, investor, and president of many successful start-ups since 1998. by Scott E. McGlon

Irrational and passionate optimism is a "must have" in your entrepreneurial arsenal if you are going to make it through the ups and downs of owning your own business. That has been written and said many time and in many ways. This "blind faith” topped with a lot of "passionate drive" will get it done. Or will it? Do you believe that either you have what it takes be a successful entrepreneur or you don't? Thinking you have it, reading about it, studying it, talking about it, and certainly not acquiring ownership in a business gives you the title of a "successful entrepreneur". If you look closely at all of those who have a proven record in being an entrepreneur possess characteristics that 95%+ of the population simple doesn't have - no matter how much education, money, or connections they have. So, yes, in my opinion, you either have it or you don't but let's dig much deeper. Everyone has heard the long-standing stat that "two out of three businesses fail". But what the stat doesn't show is the continuance of a certain percentage within the 66% failure rate and how the failure fueled and refined their quest to get up and try again. Every successful entrepreneur has failed at some point in their career. More importantly, some of the most successful people I have met have hit rock bottom at least one time prior to making it big on their own. The difference is simple: failure either scares you enough that quitting becomes a real option or completely drives you to another level to try even harder. Unfortunately, I would say at least 95% fall under the "once failed - won't happen again" group. Successful entrepreneurs don’t let being rejected or failure keep them down. This "pride blocker" is part of the most successful entrepreneur's DNA. This is great and everything but doesn't really define the secret sauce that is truly the nucleus of every great entrepreneur. While a lot of folks look at life full of wins and losses, most entrepreneurs look at it as wins and learned! Going back to the certain percentage within the 66% failure rate, the one characteristic they come out on the other side with is experience with failure - a set of negative variables that ended in failure. So, what is the secret that every entrepreneur should know? Take note - most entrepreneurs that have achieved success consistently deploy well thought out mental strategies to manage disappointment. Huh? What a minute - all my life I have been told "be positive" and "think good thoughts". That's perfect when you are in the 5th grade! Every great entrepreneur has a well-defined parameter of his or her business. It's almost like thinking through every scenario possible that could go wrong and having primary, secondary, and tertiary plan lined up ready to be executed without one ounce of frustration or distraction setting in. This is where both resiliency and determination overcome and bury the many challenges any business owner faces - especially in the first 24 months being in business. Without a doubt, the majority of new entrepreneurs invest a lot of time knowing every aspect of everything that they think is going to go right. Unfortunately, there isn't a lot of time invested in thinking about everything that's not. It's the bold and challenging road of determining every possible roadblock that you think could potentially happen and creating a game plan to counter it. This line of thinking and planning will also assist your pursuit of getting funding. The ability to answer the tough questions thoroughly are the ones who usually get the biggest investors interested. Good luck! Scott E McGlon is the President of McGlon Properties, LLC and the author of many blog post on MP Blog. He has been a serial entrepreneur, investor, and president of many successful start-ups since 1998. |

Multiple AuthorsMP, LLC credits blog post with the original author and links (if available). Categories

All

AuthorScott E McGlon is the President of McGlon Properties, LLC and the author of many blog posts on MP Blog. He has been a serial entrepreneur, entrepreneur-in-residence, investor, and president/CEO of many successful start-ups since 1998. “Success is walking from failure to failure with no loss of enthusiasm." - Winston Churchill "The few who actually

go out and take extraordinary initiatives are the envy of the majority who sit back and just observe." “The LORD makes firm the steps of the one who delights in Him; though he may stumble, he will not fall, for the LORD upholds him with His hand.” - Psalm 37:23-24

“Keep away from people who try to belittle your ambitions. Small people always do that, but the really great people make you feel that you, too, can become great.” "It is more important in what you become than what you achieve. What are you going to become in pursuit of what you want?" - John Marsh, Marsh Collective

“Work harder on yourself than you do on your job" - Jim Rohn

"The secret to success is very simple: EVERYDAY if you do quality work, take initiative, act on innovative thoughts, and are assertive in your actions all backed by faith, the dividends will consistently flow your way." - SEM

|

Real Estate Properties | Business Blog | Our Ethos | Press Releases | TENANTS ONLY | Contact Us

Terms & Conditions | Privacy Policy | Gameday Condos Auburn AL All rights reserved. Auburn Football Memorabilia

Corporate Offices: McGlon Properties, LLC - Auburn Alabama - [email protected]

Corporate Offices: McGlon Properties, LLC - Auburn Alabama - [email protected]

RSS Feed

RSS Feed